Last Modified: 10/31/2024

Location: FL, PR, USVI

Business: Part A, Part B

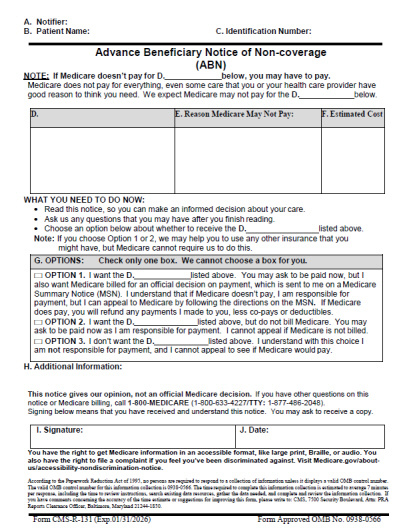

An

advance beneficiary notice (ABN)

is a written notice which a physician, provider, or supplier give to a Medicare beneficiary before items or services are furnished when the physician, provider, or supplier believes Medicare probably or certainly will not pay for some or all the items or services.

ABN “notifiers” include:

• Physicians

• Providers (including institutional providers like outpatient hospitals)

• Practitioners (paid under Part B)

• Suppliers (paid under Part B)

• Hospice providers

• Home health agencies (paid exclusively under Part A)

• Religious non-medical health care institutions (paid exclusively under Part A)

Notifiers must complete the ABN as described below and deliver the notice to affected beneficiaries or their representative before providing the items or services that are the subject of the notice. Although Medicare inpatient hospitals use other approved notices for this purpose, skilled nursing facilities use this ABN for Part B items and services.

Please do the following when you want to have a beneficiary sign an ABN:

• Review the ABN with the beneficiary or his/her representative and answer any questions before they sign the form.

• The ABN must be delivered far enough in advance the beneficiary or representative has time to consider the options and make an informed choice.

• Once all blanks are completed and the form is signed, a copy is given to the beneficiary or representative.

• In all cases, the notifier must retain the original ABN on file.

Note: Employees or subcontractors of the notifier may deliver the ABN. ABNs are never required in emergency or urgent care situations.

When a notifier believes Medicare will deny a service as not reasonable and necessary or too frequent, an ABN to the beneficiary can protect the notifier from liability. One year is the limit for use of a single ABN for an extended course of treatment. If the course of treatment extends beyond one year, a new ABN is required for the remainder of the course of treatment.

An ABN may be applied to an extended course of treatment provided the notice identifies each service for which Medicare is likely to deny payment. A separate notice is required, however, if additional services for which Medicare is likely to deny payment are furnished later during treatment not outlined on the initial ABN.

An ABN given on a routine basis, which does no more than state Medicare payment denial is possible, is not an acceptable ABN. Medicare also does not accept statements such as, “I never know if Medicare will deny payment,” and similar generalizations for advance notice purposes.

The provisions on ABNS are only effective when the advance notices are in writing, signed by the beneficiary, and dated.

Note: ABNs must not contain the beneficiary’s Medicare Beneficiary Identifier (MBI) or Social Security number (SSN).

The GA modifier is defined as waiver of liability statement issued as required by payer policy.

• Use the GA modifier to report an ABN was provided to the beneficiary indicating the likelihood of denial of the service as being not reasonable and necessary under Medicare guidelines.

• Report when you issue a mandatory ABN for service as required and is on file.

• You do not need to submit a copy of the ABN, but one must be available upon request.

• The most common example of these situations would be services adjudicated under a Local Coverage Decision (LCD).

• The presence or absence of this modifier does not influence Medicare's determination for payment.

• Line item is submitted as covered and Medicare will make the determination for payment.

• If it's determined the service is not covered, the claim denial is under "medical necessity denial."

• It is inappropriate to use the GA modifier when the provider/supplier has no expectation an item or service will be denied.

• Do not use on a routine basis for all services performed by a provider/supplier.

• In cases where you elect to use ABNs, you must use the GA modifier. The use of the GA modifier will indicate an ABN was provided to the beneficiary.

• Submission of a claim with a GA modifier eliminates the need for Medicare to notify the beneficiary a refund may be due or to consider further the question of whether a refund is required in the event it is determined the services are not reasonable and necessary. This method is the most efficient, since the provider avoids liability and makes Medicare aware the beneficiary understands he/she is liable.

GX modifier

The GX modifier is defined as a notice of liability issued, voluntary under payer policy.

• Use the GX modifier to report a voluntary ABN was issued for a service that Medicare never covers because it is statutorily excluded or is not a Medicare benefit.

• Line items submitted as non-covered will be denied as beneficiary liable.

• The GX modifier can be used in combination with the GY modifier, when applicable.

GY modifier

The GY modifier is defined as an item or service statutorily excluded, does not meet the definition of any Medicare benefit.

• Use the GY modifier to report that Medicare statutorily excludes the item or service, or the item or service does not meet the definition of any Medicare benefit.

• Services provided under statutory exclusion from the Medicare Program; the claim would deny whether the modifier is present on the claim.

• It is not necessary to provide the patient with an ABN for these situations.

• Situations excluded based on a section of the Social Security Act.

• Modifier GY will cause the claim to deny with the patient liable for the charges.

• Do not use on bundled procedures or on add-on codes.

• Line items submitted as non-covered will be denied as Patient Responsibility

• The GY modifier can be used in combination with the GX modifier, when applicable.

GZ modifier

The GZ modifier is defined as an item or service expected to be denied as not reasonable and necessary.

• Use the GZ modifier to report when you expect Medicare to deny payment of the item or service due to a lack of medical necessity and no ABN was issued.

• This is an informational modifier only.

• Medicare will adjudicate the service just like any other claim.

• If Medicare determines the service is not covered, denial is under "medical necessity." The denial message will indicate the patient is not responsible for payment.

• Medicare will auto-deny services submitted with a GZ modifier. The denial message indicates the patient is not responsible for payment; deny provider liable.

• If you did not have an ABN signed by the beneficiary, use a GZ modifier to indicate you expect Medicare will deny a service as not reasonable and necessary.

The ABN, Form CMS-R-131, and form instructions have been approved by the Office of Management and Budget (OMB) for renewal. The use of the renewed form with the expiration date of January 31, 2026, became mandatory on June 30, 2023.

Any ABN signed on or after June 30, 2023, with a prior expiration date will not be considered valid.

The ABN must be prepared with an original and at least one copy. The beneficiary is given a copy of the signed and dated ABN immediately, and the notifier must retain the original ABN in the beneficiary’s record. In certain situations, such as delivery by fax, the notifier may not have access to the original document upon signing. Retention of a copy of the signed document would be acceptable in specific cases such as this.

In general, retention of the signed ABN is five years from discharge or completion of delivery of care when there are no other applicable requirements under State law. Retention is required in all cases, including those cases in which the beneficiary declined the care, refused to choose an option, or refused to sign the notice. Electronic retention of the signed paper document is acceptable.

In accordance with §1879 of the Social Security Act (the Act), when assigned services are denied because they are determined to be not reasonable and necessary, the Medicare program makes payment when neither the beneficiary nor the physician knew, and could not reasonably be expected to have known, the services were not reasonable and necessary based on Medicare guidelines.

As explained in §1842 of the Act, nonparticipating physicians who provide services to Medicare beneficiaries on an unassigned basis are obligated to refund any amount collected from a beneficiary for services for which the Medicare reasonableness and medical necessity limitations are not met. However, a refund is not required if the physician did not know, or could not reasonably have been expected to know, Medicare would not pay for the service; or if prior to providing the service, the physician notified the beneficiary in writing the service would not be covered by Medicare, and the beneficiary signed a written agreement to pay for the service.

First Coast Service Options (First Coast) strives to ensure that the information available on our provider website is accurate, detailed, and current. Therefore, this is a dynamic site and its content changes daily. It is best to access the site to ensure you have the most current information rather than printing articles or forms that may become obsolete without notice.

is a written notice which a physician, provider, or supplier give to a Medicare beneficiary before items or services are furnished when the physician, provider, or supplier believes Medicare probably or certainly will not pay for some or all the items or services.

is a written notice which a physician, provider, or supplier give to a Medicare beneficiary before items or services are furnished when the physician, provider, or supplier believes Medicare probably or certainly will not pay for some or all the items or services.  .

. .

. .

.

and Chapter 30, Section 50.6.4

and Chapter 30, Section 50.6.4  .

.