Home ►

Billing news ►

COVID-19 vaccine and monoclonal antibody billing for Part A providers

Last Modified: 2/14/2025

Location: FL, PR, USVI

Business: Part A

This article will assist Medicare Part A providers with proper billing relating to COVID-19 vaccine and monoclonal antibody (mAb) infusion. Beneficiary coinsurance and deductible are waived.

For billing single claims for COVID-19 vaccines and monoclonal antibodies, follow the instructions in the article below:

• On or after January 1, 2022, claims for vaccine or mAb administrations for Medicare Advantage enrollees should be submitted to the Medicare Advantage plan. For services provided to Medicare Advantage enrollees on or after January 1, 2022, contact the Medicare Advantage for guidance on coverage and billing.

The types of bill (TOBs) to report for the COVID-19 vaccine and mAb infusion on the Part A claim form, or electronic equivalent, are:

• Inpatient Part B

• Hospital -- 12X

• SNF -- 22X

• Outpatient

• Hospital -- 13X

• SNF -- 23X

• End stage renal disease -- 72X

• Comprehensive outpatient rehabilitation facility -- 75X

• Critical access hospital -- 85X

• Revenue codes:

• 0771 -- Preventive care services, vaccine administration

• 0636 -- Pharmacy, drugs requiring detailed coding

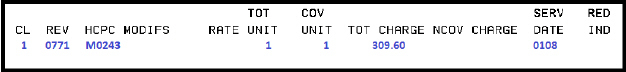

Billing example for first dose:

Condition code:

• A6 – 100% payment

Diagnosis code:

• Z23 – Encounter for immunization

• Required as primary diagnosis

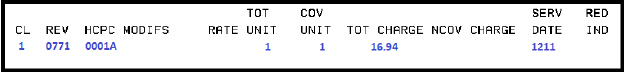

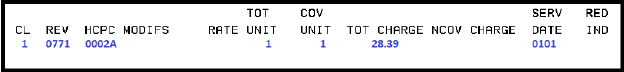

Billing example for second dose:

Condition Code:

• A6 - 100% payment

Diagnosis code:

• Z23 - Encounter for immunization

Note: For vaccines provided for inpatients, use the date of discharge or date Part A benefits exhausted as the date of service.

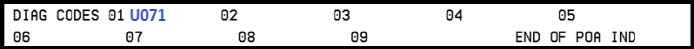

Billing example for infusion:

Diagnosis codes:

• Use appropriate diagnosis coded to highest level of specificity

•

U071 – use as appropriate

Note: For vaccines provided for inpatients, use the date of discharge or date Part A benefits exhausted as the date of service.

Independent and provider-based rural health clinics (RHCs) and federally qualified health centers (FQHCs) do not include charges for the COVID-19 vaccine and monoclonal antibodies on a claim form.

Administration of these vaccines does not count as a visit when the only service involved is the administration of the COVID-19 vaccine and/or monoclonal antibodies.

If there was another reason for the visit, the RHC/FQHC should bill for the visit without adding the cost of the COVID-19 vaccine and/or monoclonal antibodies to the charge for the visit on the bill.

Payment is made at the time of cost settlement.

To facilitate the efficient administration of COVID-19 vaccines and monoclonal antibody treatments to SNF residents, CMS will exercise enforcement discretion with respect to these statutory provisions as well as any associated statutory references and implementing regulations, including as interpreted in pertinent guidance, SNF CB Provisions. Through the exercise of that discretion, CMS will allow Medicare-enrolled immunizers, including but not limited to pharmacies working with the United States, to bill directly and receive direct reimbursement from the Medicare program for vaccinating Medicare SNF residents.

The enforcement discretion associated with vaccinating Medicare SNF residents ended on June 30, 2023, meaning that immunizers are no longer be able to bill Medicare directly for vaccines furnished to patients for a Medicare Part A-covered SNF stay. Beginning on July 1 ,2023, typical SNF consolidated billing regulations are in place, which require SNFs to bill for all services furnished to patients in a Medicare-covered SNF stay, including vaccines.

First Coast Service Options (First Coast) strives to ensure that the information available on our provider website is accurate, detailed, and current. Therefore, this is a dynamic site and its content changes daily. It is best to access the site to ensure you have the most current information rather than printing articles or forms that may become obsolete without notice.

page.

page.

and the CMS COVID-19 Monoclonal Antibodies webpages

and the CMS COVID-19 Monoclonal Antibodies webpages  .

.