Using web tools to handle top denied claims in your practice

First Coast offers several tools for you to diagnose why your Medicare claims were denied and resources to help you prevent future claims from such a fate. When a claim gets denied, with First Coast’s web tools you can solve many issues without having to call customer service or submit a written inquiry. Review these tips to improve your cash flow and save time by eliminating denied claims from your medical practice.

Handling most common denial codes

First Coast offers these tips and resources to help you avoid and reduce the most frequently occurring claim denials among providers in Florida, Puerto Rico, and the U.S. Virgin Islands.

| Denial code | Description | How to handle | How to prevent | Additional resources |

|---|---|---|---|---|

|

CO-236 National Correct Coding Initiative |

NCCI - This procedure or procedure/modifier combination is not compatible with another procedure or procedure / modifier combination provided on the same day according to the National Correct Coding Initiative or workers comp | If a modifier is applicable to the claim, apply the appropriate modifier and resubmit the claim. Be sure to submit only the corrected line. Resubmitting an entire claim will cause a duplicate claim denial. |

Use First Coast’s NCCI lookup tool to identify when certain codes are subject to the automated prepayment edits. | CMS National Correct Coding Initiative home page |

|

OA-18 Duplicate Services |

Exact duplicate claim/service | First Coast's claims systems use filters to screen out suspected duplicate claims. Such claims and claim lines are suspended. First Coast staff then review suspended claims and determine to pay or deny. Your claim may be eligible for a clerical reopening. Click here for additional information. |

Review this article for preventing duplicate claim denials When you submit a claim for multiple instances of a service, procedure or item, the claim should include an appropriate modifier to indicate that the service, procedure or item is not a duplicate. |

Prevent duplicate claims web-based training course Read more about how modifier 59 is used when billing Medicare for distinct services. How to establish your SPOT account |

|

CO-97 Bundled services |

The benefit for this service is included in the payment/allowance for another service or procedure that has already been adjudicated. If the remittance advice remark code includes: M15 - (Separately billed services or tests have been bundled. Separate payment is not allowed.) M144 – Pre/post-operative care payment is included in the allowance for the surgery provided. N70 - The claim dates of service fall within the patient’s home health episode’s start and end dates. Before providing services to a Medicare beneficiary, determine if a home health episode exists. |

Review policy indicators for the procedure code through First Coast's fee schedule look up tool. FAQ on CO-97 denial reason code Review beneficiary eligibility and benefits information in SPOT |

Review the policy indicators for this procedure in the fee schedule look up tool Check beneficiary eligibility on SPOT to determine if they are receiving home health services

|

Tips on modifiers CMS internet-only manual, Chapter 12, Medicare Claims Processing Manual - Physicians/Nonphysician Practitioners |

|

PR B9 Hospice services |

Patient is enrolled in hospice. Per Medicare guidelines, services related to the terminal condition are covered only if billed by the hospice facility to the appropriate fiscal intermediary (Part A). Medicare Part B pays for physician services not related to the hospice condition and not paid under arrangement with the hospice entity. |

Search the specialties FAQs for hospice related information. If services provided are not related to the hospice patient’s terminal condition: If claim was submitted without modifier GW, apply modifier and resubmit claim. If claim was submitted with the GW modifier, verify the diagnosis code on the claim and ensure services are not related to the patient's terminal condition. |

With your SPOT account, check beneficiary eligibility before submitting the claim to Medicare. Use First Coast's modifier validation tool to confirm relationship between modifiers and procedure codes. |

First Coast's hospice resources - List of hospice providers - https://downloads.cms.gov/files/hcris/hosp10-reports.zip |

|

PR-170 Chiropractic services |

This payment is denied when performed/billed by this type of provider.(Chiropractor) | Medicare does not cover services provided or ordered by a chiropractor that are not related to treatment by means of manual manipulation of the spine to correct a subluxation. |

When billing HCPCS 98940, 98941 and 98942 for services related to active/corrective treatment for acute or chronic subluxation, a modifier is required. Use First Coast's modifier validation tool to confirm relationship between modifiers and procedure codes. |

For additional information regarding billing for chiropractic services, review this page. Chiropractic services documentation checklist Complete online course for billing Medicare for chiropractic services. Receive 1.5 continuing education credit hours |

In addition to these tips for handling most frequently denied claims, First Coast’s provider website offers many useful tools to manage Medicare billing and prevent denied claims. The most frequently-used tools are the Interactive LCD index and fee schedule look up. However, First Coast offers several more online tools to help you save time and get paid more quickly.

SPOT – Secure Provider Online Tool

With SPOT, Medicare providers have several tools available to diagnose, correct, and prevent denied claims. SPOT gives you the ability to view claims status and patient eligibility information online, conduct detailed data analysis at the claim and provider levels, and reopen claims to make clerical corrections on multiple lines. First Coast offers SPOT to providers at no charge.

“The SPOT simplifies the claims reopening process. It makes it 10 times better to go online and find information on my claims and fix it right there. It’s real time. I’m not wasting time on the phone,” said one provider who uses several of First Coast’s web tools to manage Medicare claims.

‘Incident-to’ self-service tool

The purpose of the incident-to self-service tool is to assist providers with understanding the CMS Part B incident-to requirements and to apply the rules to their individual given patient/provider circumstances and to understand documentation requirements.

"Incident-to" services are defined as those services that are provided incident to physician professional services in the physician's office or in a patient's home. Examples may include services supervised by a physician and provided by non-physician practitioners such as physician assistants, nurse practitioners, clinical nurse specialists, nurse midwives, or clinical psychologists.

Modifier details tool

Using the modifier details tool before you file a claim can help you prevent a claim denial for an invalid combination of procedure codes and modifiers. While the existence of a valid procedure/modifier combination does not necessarily imply Medicare coverage, the tool provides a level of assurance that the coding of a claim may be valid.

Request your personalized PDS report

The top denial codes represent all Part B Medicare providers in Florida, USVI and Puerto Rico. If you would like to see the top denial codes for your medical practice, order a provider data summary (PDS) report through your SPOT account. See the SPOT User Guide: Section 5 for more information.

The PDS is a free comprehensive billing report that helps identify potential Medicare billing issues through a detailed analysis of billing patterns in comparison with those of similar provider types. This report will assist in enhancing the accuracy and efficiency of your Medicare billing process.

“Getting to the reports is very easy,” says one provider who used the reports to improve the timing of processing claims in their practice from 13 days to three. “It [PDS report] provides a snapshot of the quality of the claims we are filing,” he said.

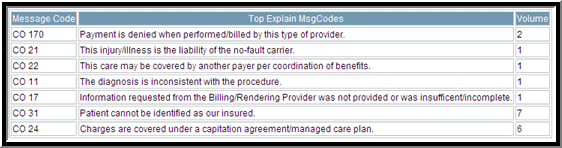

Here’s a sample of part of the PDS report that highlights top denial codes:

Learn how to access the PDS report through the SPOT in Section 5 of the SPOT User Guide.

Other important tools to use to diagnose and prevent denied claims

In addition to the PDS report, First Coast offers other helpful resources on the and Tools and Forms page as well as the CBR guide. Also, view tips on developing and implementing a compliance program.

View these resources to view denial codes and their definitions.