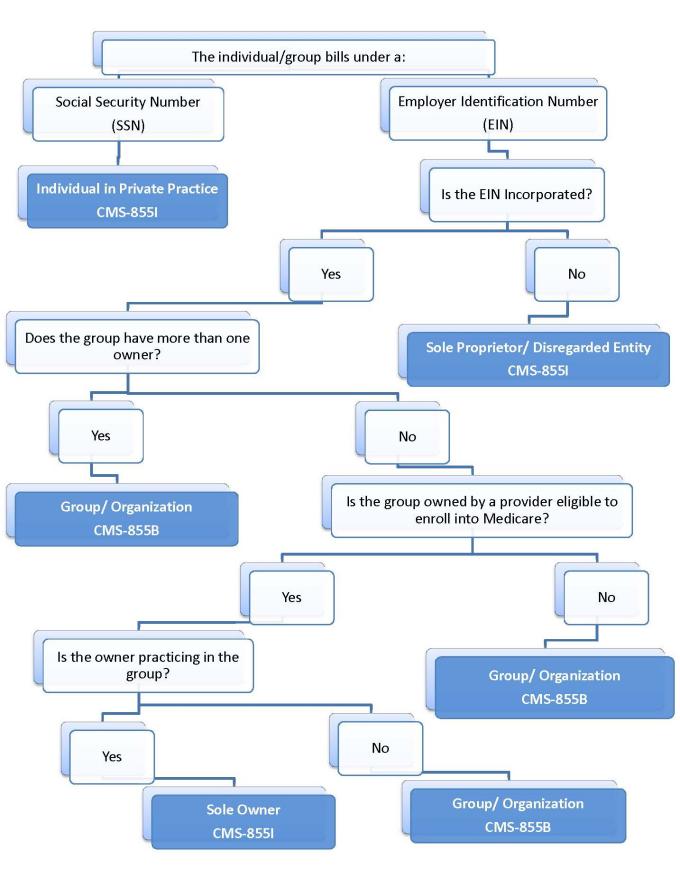

Provider enrollment decision tree

Individual, sole proprietor or disregarded entity, sole owner, group practice decision tree

To help determine if you should enroll as an individual in private practice, sole proprietor / disregarded entity, sole owner, or group practice / organization, please utilize the decision tree below.

Once you have determined how you should enroll, below is a list of what is needed for each individual / group type.

Individual in private practice must have:

- Medicare Enrollment Application – Physicians and Non-Physicians (CMS-855I) for individual practitioner

- SSN

- Type 1 NPI (Individual NPI)

- Medicare Enrollment Application - Electronic Funds Transfer Agreement (CMS-588) with a voided check or bank letterhead

- If applicable:

- Medicare Enrollment Application – Medicare Participating Physician or Supplier Agreement (CMS-460), if individual wants to have a participating status with Medicare

- Medicare Enrollment Application – Medicare Participating Physician or Supplier Agreement (CMS-460), if individual wants to have a participating status with Medicare

Sole proprietor / disregarded entity must have:

- Physicians and Non-Physicians (CMS-855I) for sole proprietor/disregarded entity

- SSN

- Type 1 NPI (Individual NPI)

- Employer identification number

- CP 575, IRS document

- Electronic Funds Transfer Agreement (CMS-588) with a voided check or bank letterhead

- If applicable:

Sole owner must have:

- Physicians and Non-Physicians (CMS-855I) for sole owner

- SSN

- Type 1 NPI (Individual NPI)

- Employer identification number

- Type 2 NPI (Group NPI)

- CP 575, IRS document

- Electronic Funds Transfer Agreement (CMS-588) with a voided check or bank letterhead

- If applicable:

Group or organization must have:

- Medicare Enrollment Application – Clinics / Group Practices and Other Suppliers (CMS-855B)

- Employer identification number

- Type 2 NPI (Group NPI)

- CP 575, IRS document

- Electronic Funds Transfer Agreement (CMS-588) with a voided check or bank letterhead

- If applicable:

- Medicare Enrollment Application – Medicare Participating Physician or Supplier Agreement (CMS-460), if individual wants to have a participating status with Medicare

- Medicare Enrollment Application – Medicare Participating Physician or Supplier Agreement (CMS-460), if individual wants to have a participating status with Medicare